Unearthing the Data Goldmine: How Financial Institutions Can Harness Their Wealth of Information

Unearth Your Data Goldmine: The Power of Data in Financial Institutions

In 1849, M.F. Stephenson exclaimed, “There’s gold in them there hills!” redirecting locals from a gold rush to California when riches were right beneath their feet. Today, a similar notion rings true: "There’s gold in that there data!" Financial institutions, much like those hills, are sitting on a data goldmine.

For banks and credit unions, the treasure trove lies within the vast amount of customer data they possess. This abundance of information is envy-inducing for other industries. Analytics Insight corroborates this, highlighting the financial sector's colossal data volume generated through activities, transactions, and digital footprints.

Yet, having data is just the start. Utilizing it effectively requires the right tools and approach. The data held by financial institutions is not just personal or security-based; it encompasses invaluable transactional insights, making relationship-building opportunities abundant.

The Data is the Gold

Every financial institution houses a core dataset composed of customer information and transactions. Unveiling deeper insights from this data demands effort. Although third-party vendors offer additional data, the in-house repository within financial institutions holds immense power. However, often, this data resides in silos across different business lines, hindering a holistic view of customers.

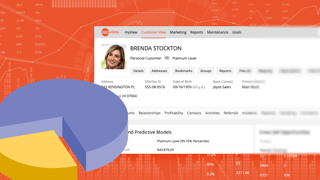

A solution lies in Customer Relationship Management (CRM) systems. These systems integrate disparate data sources, offering a comprehensive customer view. They empower institutions to better understand customers and engage with them meaningfully.

The CRM is the Shovel

A CRM consolidates multiple data sets, providing a cohesive customer portrait. It's the tool institutions need for informed customer relationships, ensuring the right product or service reaches the right customer at the right time. It acts as the shovel, essential for mining this data gold.

Marketing Automation Uses the Gold in a Big Way

Once data access is secured, marketing automation becomes pivotal. It scales meaningful interactions, enabling proactive and strategic communication with customers and prospects. Automation streamlines tasks, saving time and enhancing personalization, which can translate to increased customer engagement and loyalty.

The amassed data holds invaluable insights into each customer's story. Leveraging this requires additional tools. Just like in a gold mine, a shovel is the first step. For data utilization, marketing automation becomes the catalyst for growth.

Learn more about 360 View today or request a demo!

If you’re ready to transform from merely sitting on a data goldmine to actively mining its value, consider partnering with an industry provider. 360 View, a CRM platform tailor-made for financial institutions, offers not only a user-friendly and robust CRM but also a comprehensive marketing automation module.

Unlock the potential of your in-house data; start digging with 360 View.